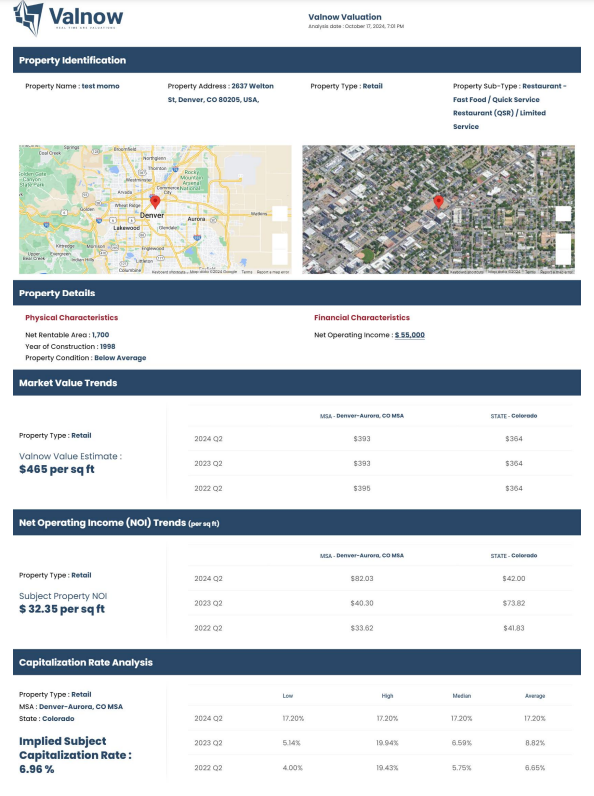

Valnow Valuation

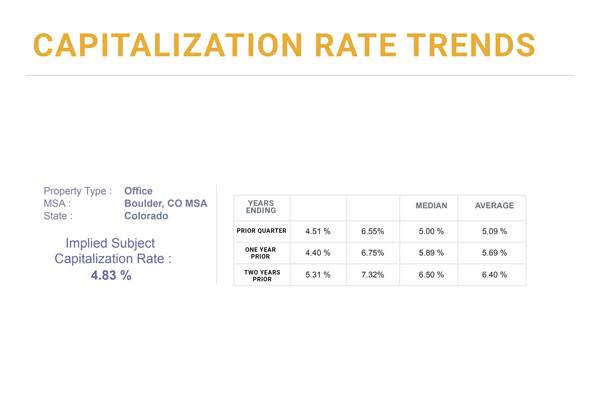

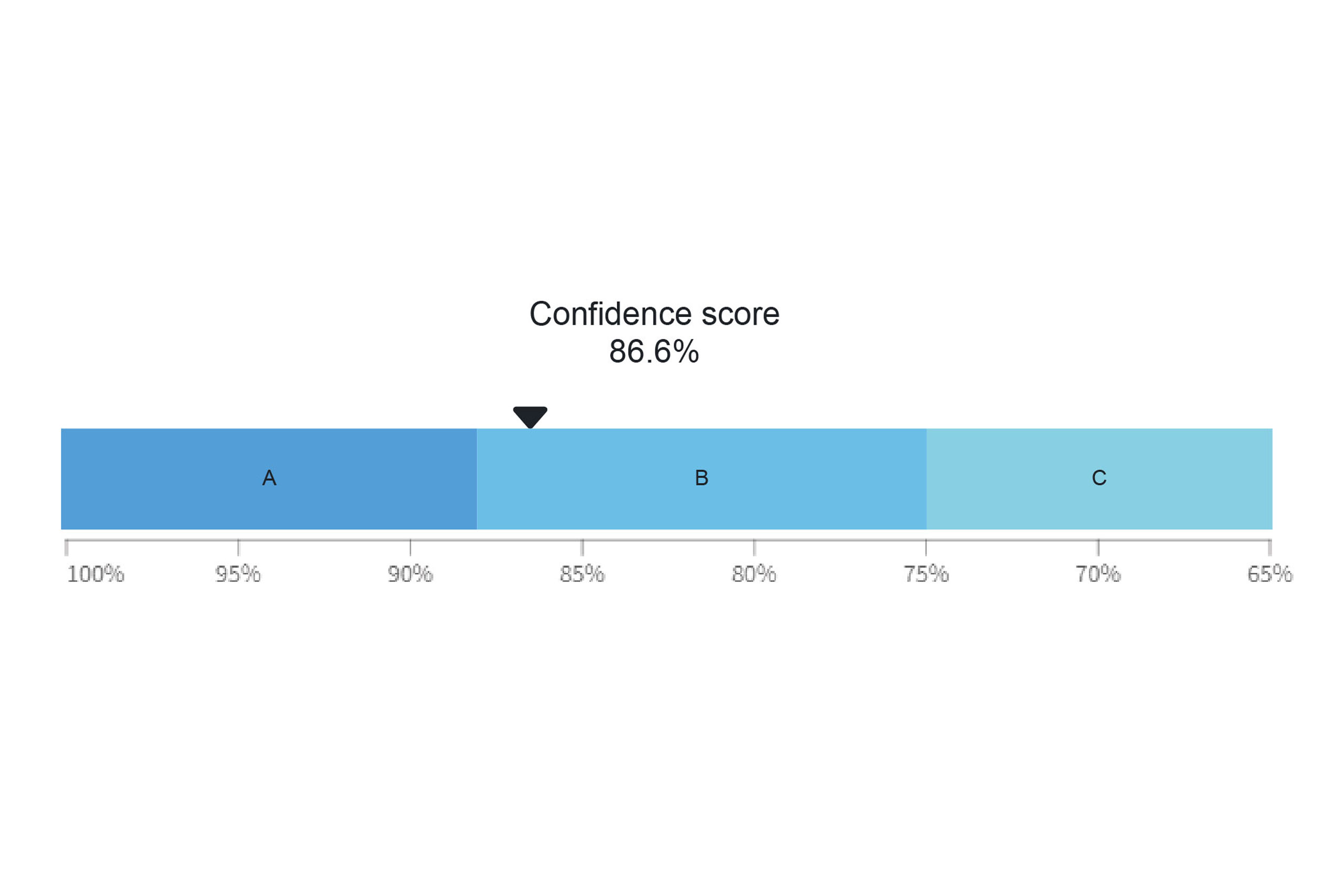

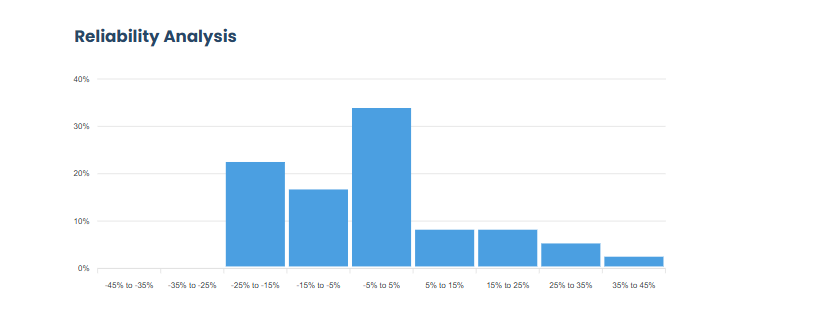

Valnow utilizes multiple powerful artificial intelligence algorithms.

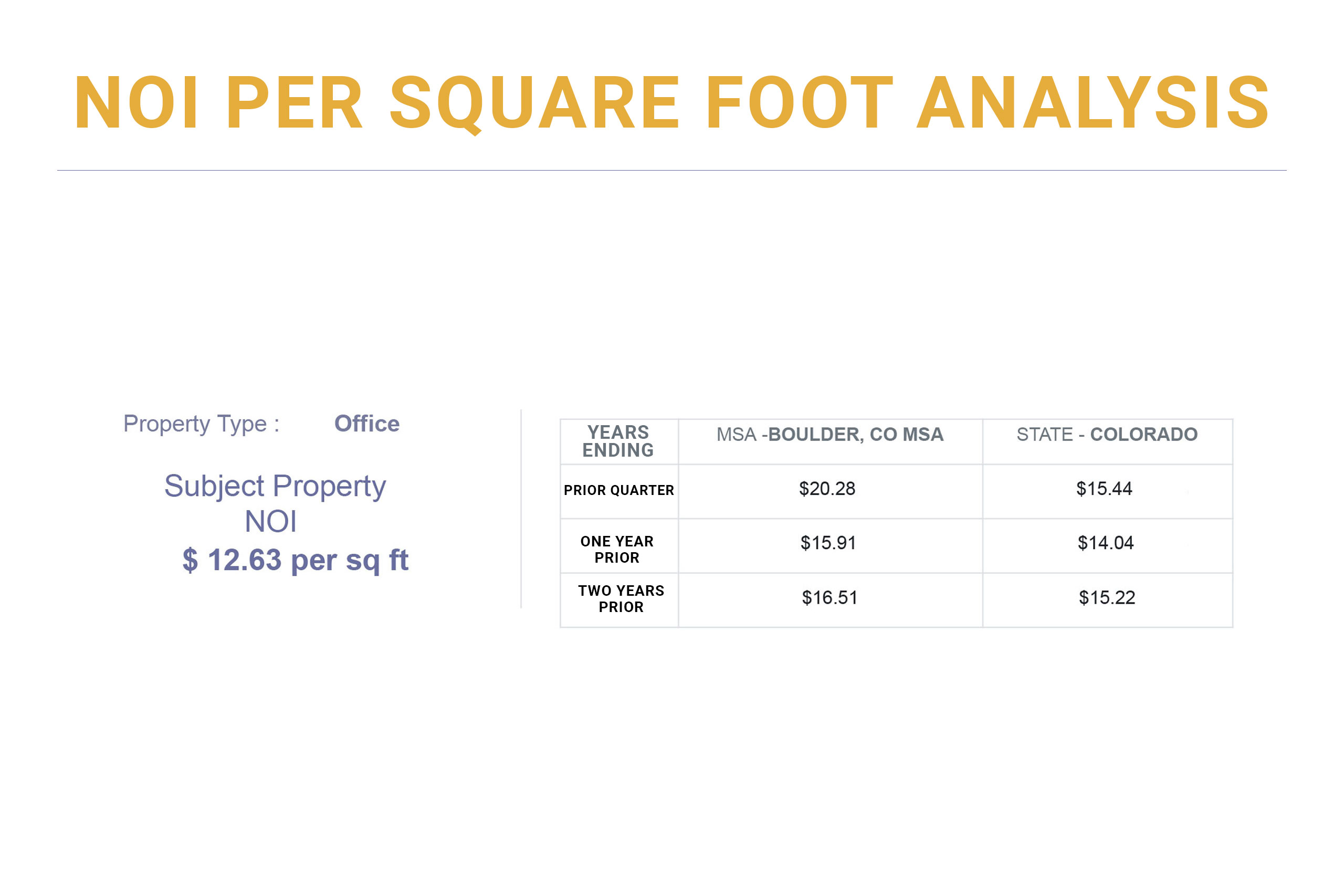

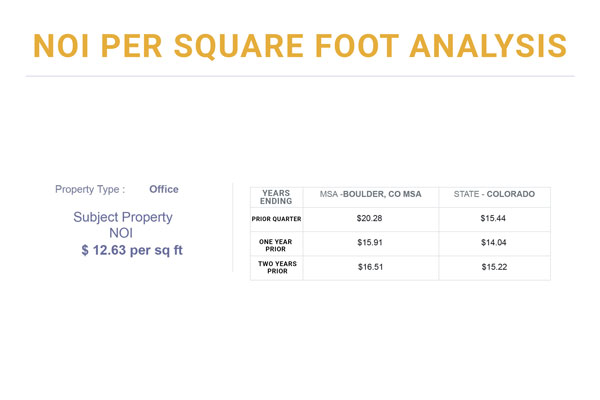

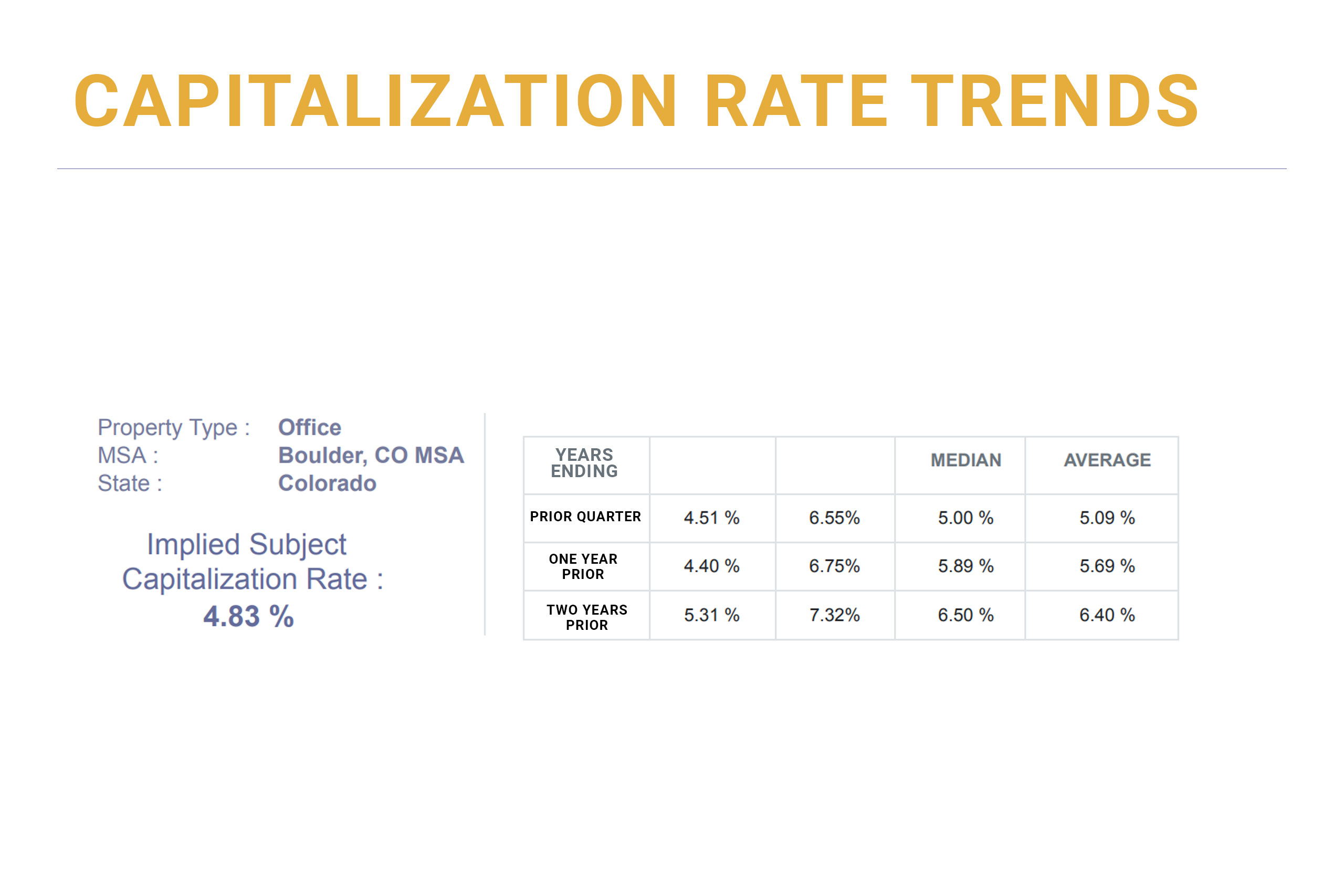

Data is collected, cleaned, enriched, and used to train our models.

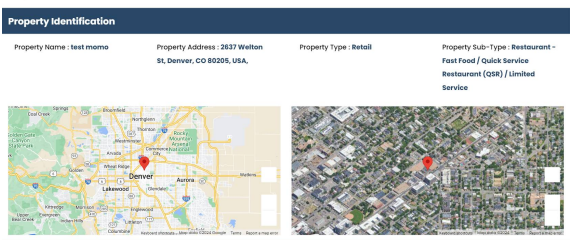

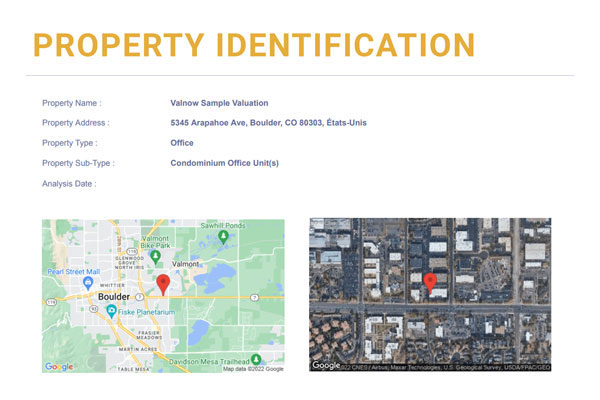

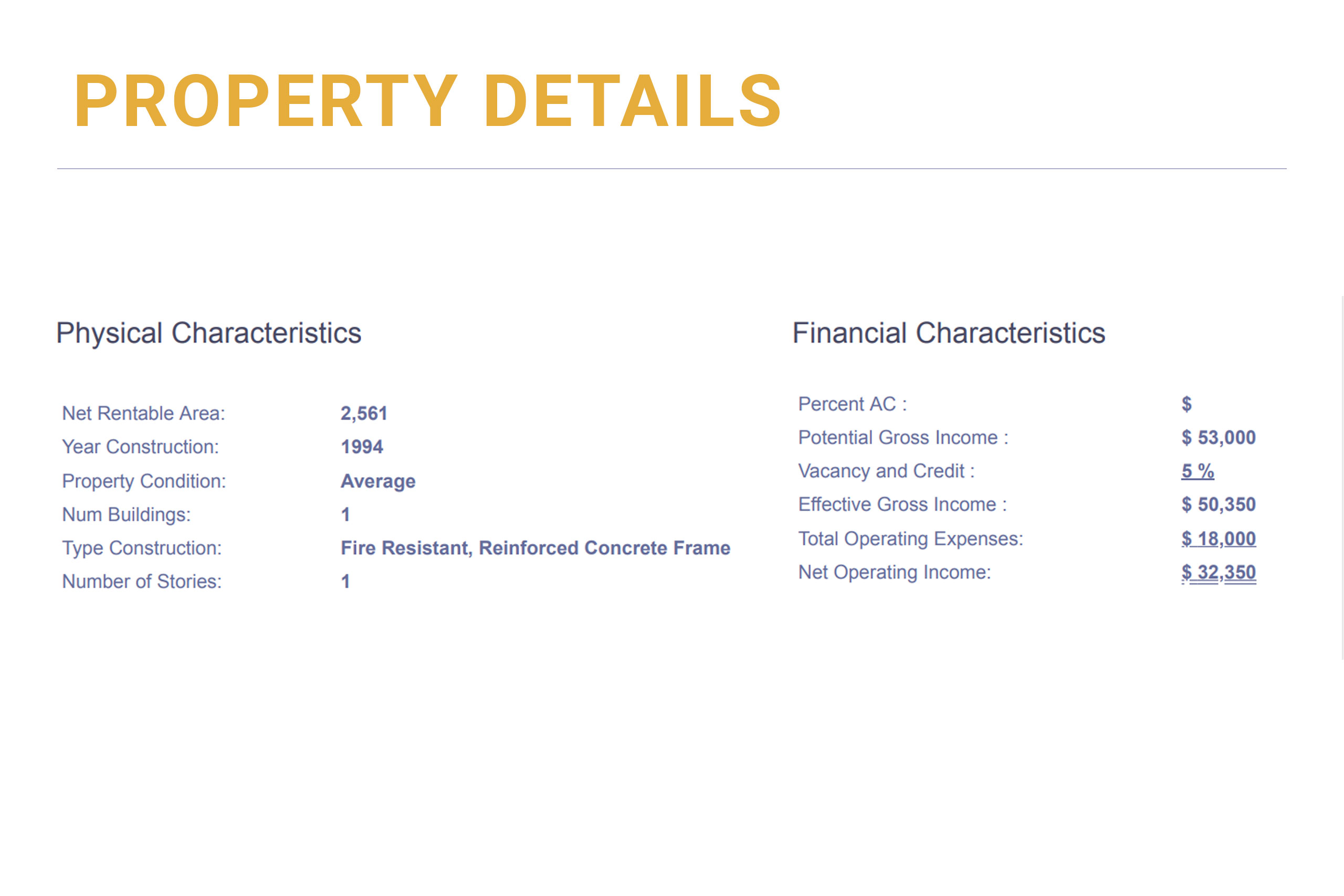

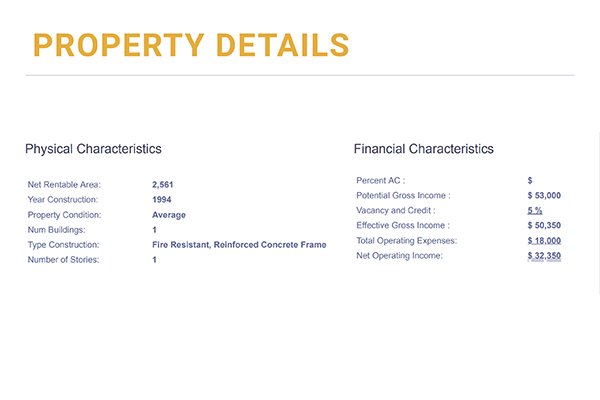

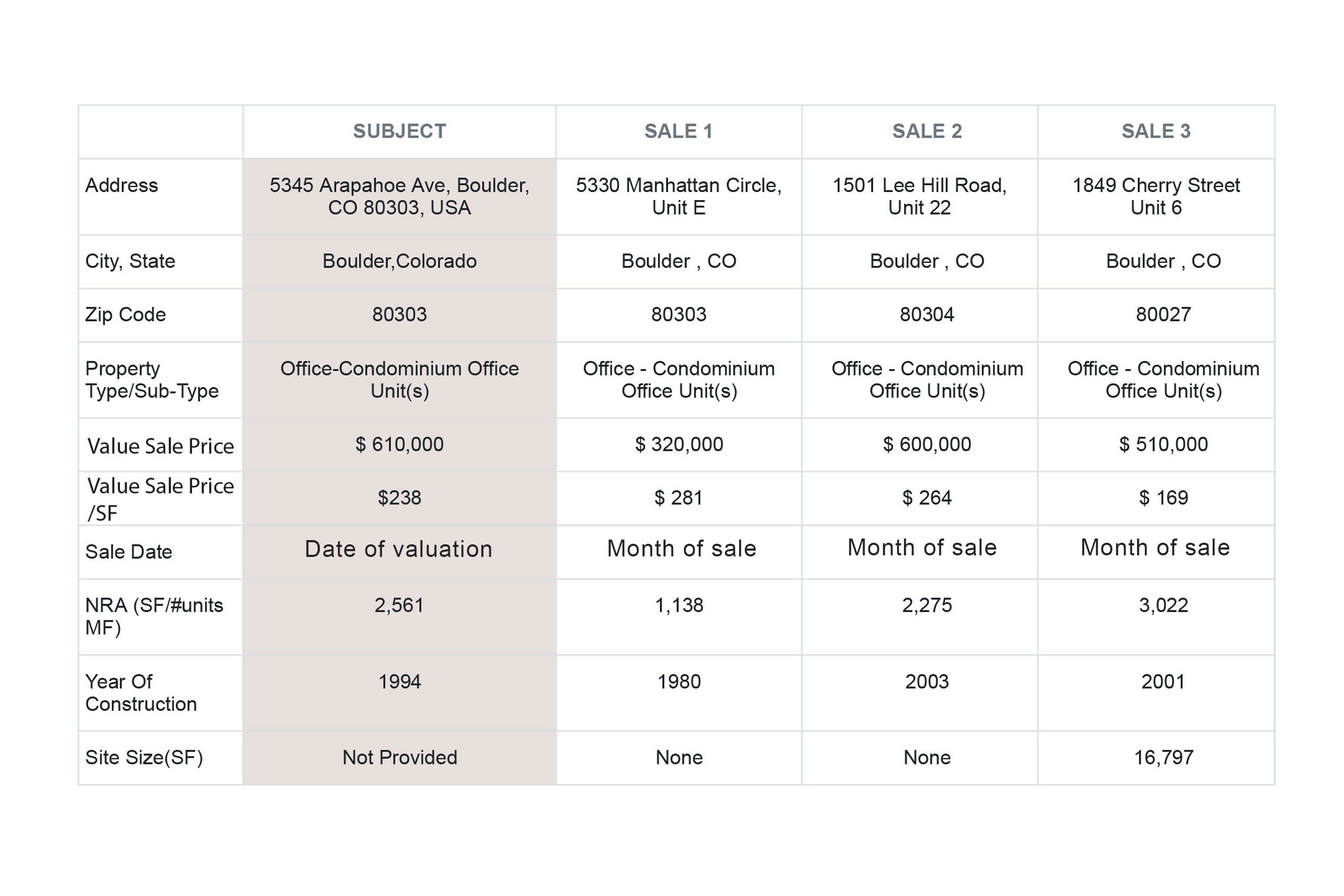

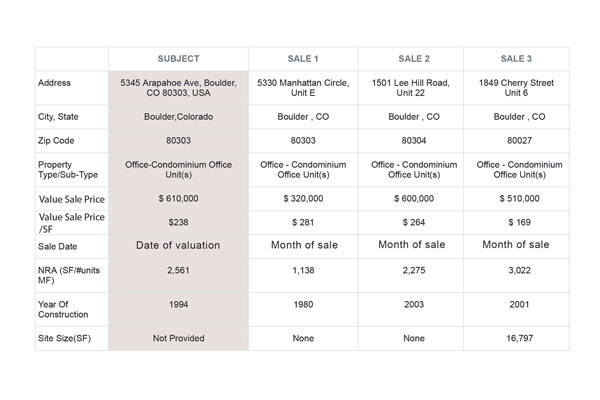

The user enters the subject property address, relevant physical and financial characteristics.

The results are then analyzed and validated prior to presentation to our users.